| Overview

and Effective Interest Rate Model Inputs

ASC 310-20 (formerly FAS91) requires

that companies determine the effective interest rate on certain financial

instruments after taking into consideration fees, costs, discounts or

premiums. These amounts are then deferred and amortized over the term

of the underlying instrument.

To meet this need, we provide the Effective Interest

Models. There are two available models: the Fixed Interest Rate model

and the Variable Interest Rate model. The Fixed rate model allows only

a single interest rate for the entire instrument term and the variable

rate model allows monthly interest rate changes.

Effective Interest Rate Model Inputs

Our Effective Interest Model allows you to compute monthly

level yield and straight line amortization of debt instruments principal,

interest

and the deferred fees, costs and discount/premium.

The following inputs are collected for all scenarios

as a basis for computation (see Figure 1):

| Instrument Name, Instrument Number and Notes |

These inputs allow you to describe the instrument that is being

modeled. |

| Date of Origination |

The date to start the instrument amortization model. This date

is used as the starting point for the number of months in the term. |

| Principal Balance |

This input is the starting balance of the instrument and is the

baseline value that is reduced with payments. |

| Stated Interest Rate/Starting Interest Rate |

Interest rate to use for the instrument. The Fixed rate model version

allows only a single interest rate. The Variable rate model allows

for monthly interest rates so this input is simply the starting interest

rate (default value for each month). |

| Originator, Holder Status, Interest Index, Interest Details

and Instrument Type |

These inputs provide additional information relating to this instrument.

For example, the Originator allows you to enter information relating

to the organization that originated this instrument and the Instrument

Type input allows you to describe the broad category of this instrument. |

| Interest Model |

The Interest Model input can be either 360/30 or Actual Days. The

360/30 model assumes that there are 30 days in each month and 360

days per year for monthly interest computations. The Actual Days

model computes interest using the actual calendar number of days

in each month (e.g. 28 days in February on non-leap years and 29

days

in

leap years). Either model can be used to compute the amortization. |

| Term (Months) |

The number of months until this Instrument is paid off and the

term to use for amortization. This input may be any number between

3 and 480 months allowing maximum flexibility. At the end of the

term, the loan is assumed to be paid off. |

| Fees |

Fees represent amounts paid to a lender to enter into a transaction.

It does not matter if you are the lender or the borrower, fees paid

will increase the yield on an instrument. The fee field can also

be used for debt issuance costs as these costs will also increase

the yield or cost of the instrument. |

| Costs |

If the lender status box is checked, you will also be able to input

a cost amount. This field should only be used by lenders, and represents

costs incurred to originate a debt instrument. |

| Premium/Discount |

The Premium/Discount input is a positive value indicating the amount

of the Premium/Discount (there may only be either a premium or a

discount for a given instrument). This amount represents the amount

under

or over par value. For example, if a lender charged discount points

on a loan, this would be considered a discount and would increase

the yield. This field is also used for instruments sold on the secondary

market which could be sold for less than par value (discount) or

more than par value (premium). |

| Discount/Premium Radio Button |

The Premium/Discount Radio Button allows you to identify the Premium/Discount

input as either a Premium or a Discount. When the Radio button changes,

all references to this amount also change to reflect the Premium/Discount

nature of this amount. |

| Payment Terms Radio Button |

The payment terms can also be adjusted to fit the terms of the

instrument. Standard terms (in which principal and interest are paid

monthly), Interest-only (monthly interest with principal paid at

the end of the term) and Balloon terms (single payment at the end

of the term) are all supported. |

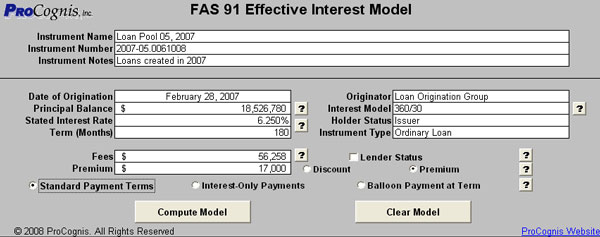

Figure 1a. Input screen for all scenarios to provide

basis for computation-Fixed Interest Rate Model. This screenshot is with

the Lender Status set to false. Premium Radio button selected.

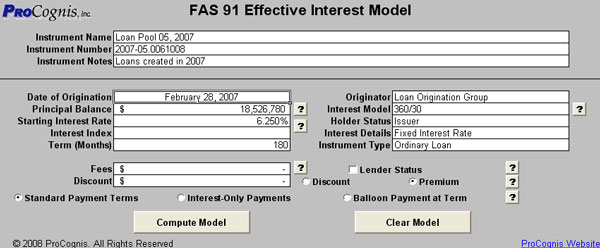

Figure 1b. Input screen for all scenarios

to provide basis for computation-Variable Interest Rate Model. This screenshot

shows the Lender Status and Cost input. Discount Radio Button selected.

Lender Status

The models provide a checkbox to indicate whether

you are the Lender for this instrument (Lender Status in Figure 1). Lender

Status checkbox should be checked if you are the Lender or originator

for this instrument so that you can compute Cost amoritzation.

Note that major inputs have buttons marked with  .

These buttons open help windows describing the input and providing information

on the use of that information. .

These buttons open help windows describing the input and providing information

on the use of that information.

Go

on to Effective Interest Model Output and Straight Line Analysis >

|